Could we be about to see a ‘miner spring'?

The strike, and the violent repression of the miners, has sent shockwaves through South African society and the global mining industry, and raised the prospect of a ‘miners' spring' as wildcat strikes have rapidly spread to mines belonging to other companies, including Anglo American Platinum (subsidiary of the British owned Anglo American), London Stock Exchange registered AngloGold Ashanti, and New York stock exchange listed Gold Fields.

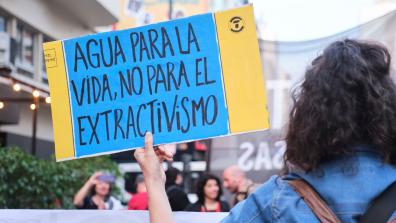

Mining is South Africa's biggest industry and makes billions of dollars in profits for corporations every year. However, the strike at Marikana has brought to light the grinding poverty and dangerous working conditions endured by those workers who toil to produce the wealth of the global mining industry. Many of the miners live in tin shacks which lack basic services, such as water, electricity and sewerage. Martin Hahn, a mining specialist at the International Labour Organisation, has described how dangerous working conditions in South Africa's mines often expose workers to falling rocks, dust, intensive noise, fumes and high temperatures. The victory of the Marikana miners serves as an example for hundreds of thousands of miners not just within South Africa's borders but also beyond, as unfair treatment by mining corporations is increasingly questioned.

There has been much talk in the Western media of the damage which the strikes are doing to the corporations involved, with Lonmin arguing that it may have to default on payments and review the long-term sustainability of its operations. Nonetheless, even the most business-friendly observer will appreciate the irony of a company which had a turnover last year of $2 billion (based on its platinum mining operations in South Africa) pleading poverty, while media images show its workers living in squalid conditions and being gunned down live on national television. Meanwhile, global financial markets have acted to pressurise the South African government to clamp down on the wave of strikes. The influential credit ratings agency Moody's this week downgraded South African debt for the first time since apartheid, citing the government's “reduced capacity to handle the current political and economic situation”, while the value of shares in Lonmin has fallen by 20% since the massacre.

The reaction of the mining corporations to workers' protests has been one of threats and violence perpetrated by security forces protecting the companies' interests. Even after the slaughter of 34 workers brought global sympathy for the miners' cause and shone attention on the dispute, Lonmin threatened to fire 3000 workers if they didn't return to work, and last week Anglo American (which made profits of $890 million from its platinum mines in South Africa last year) announced that it was seeking to have the strike at one of its mines near Rustenburg declared illegal, which would then allow it to fire any worker participating in the action. Meanwhile, strike leaders reported that another miner was killed at the same pit on 19 September after being run over by a police armoured car during violent clashes between the police and striking workers.

However, it seems that the corporations' hostile response will not be sufficient to quell the unprecedented wave of large scale workers' resistance. Sidumo Dlamini, head of the Congress of South African Trade Unions, said last week, “What we see happening at Marikana and elsewhere is that workers are essentially demanding a living wage. Workers are simply saying, ‘We produce wealth and we want our reasonable share, and they expect to be given a fair share.' This is a reflection of the demands being harbored by millions of our people”.

What really worries the corporations and the global financial markets is the prospect of the growing militancy of South African miners, in their demand for a living wage which allows them a dignified existence, spreading to other countries, in the same way that Tunisian protests lit the touchpaper for the Arab Spring last year. In a sign that industrial conflict could spread to the mining industry in neighbouring Zambia, the Chinese administrator manager of the Chinese-owned Collum coalmine was killed by striking workers in another dispute over low pay in August. The Collum mine hit the news in October 2010 when Chinese managers shot and injured eleven protesting miners. The strikes spreading throughout South Africa's mining sector may only represent the beginning of a snowball unleashed by the massacre of Marikana workers.